Retail Technology Leaders Crushing Laggards with 99% Higher Profitability and 71% Greater Sales Growth, says IHL Study

New IHL Group Study Quantifies Widening Performance Gap as Early Adopters Increase IT Spending 3.8x Faster Than Laggards

The laggards aren't just a little behind – they're being left in the dust at the store level. Over the past 5 years, leaders have grown their Store IT spending at a cumulative rate 5.8x higher.”

NASHVILLE, TN, UNITED STATES, December 16, 2025 /EINPresswire.com/ -- A stark technology divide is reshaping the retail landscape, with early adopters of AI, electronic shelf labels, and geo-location technology achieving profitability gains 99% higher than their peers, according to IHL Group's new research study called How Retail Leaders Outperform – What We Learned from 400+ Brands. The research reveals that technology investment discipline has become the single most important predictor of retail financial performance, creating an accelerating gap between winners and losers that compounds with each technology refresh cycle.— Greg Buzek

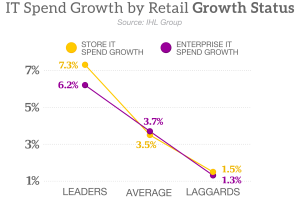

The study documents how retailers classified as "Leaders" – defined by superior financial performance – have increased their Enterprise IT spending by 56% over the past five years, compared to just 13% for laggards. This 3.8x difference in IT investment velocity translates directly into measurable competitive advantages across profitability, sales growth, and operational efficiency. The data reveals which specific technologies deliver the highest returns and quantifies exactly how much leaders outperform across dozens of financial and operational metrics.

"We're witnessing a fundamental bifurcation in retail where technology adoption is no longer just an advantage – it's become the primary determinant of who wins and who falls behind," said Greg Buzek, President of IHL Group. "Early adopters of electronic shelf labels are seeing 75% higher sales growth than those not using. Retailers deploying geo-location technology are achieving 104% greater profit growth. The performance gap isn't narrowing; it's accelerating. Retailers who think they can catch up later are deluding themselves – every quarter they wait, the gap widens further."

The study identifies critical technology adoption patterns that separate winners from losers:

* Early adopters demonstrate dramatically superior financial performance across all measured metrics, with profitability advantages approaching 100% over peer retailers and sales growth exceeding competitors by more than 70%.

* Specific technologies show quantifiable ROI advantages, with electronic shelf labels, geo-location capabilities, and mobile devices for store associates ranking among the highest-impact investments retailers can make.

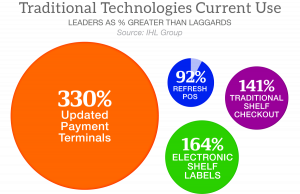

* Leaders are dramatically more likely to have deployed critical technologies including payment terminal upgrades (showing significant adoption advantages), self-checkout solutions (contrary to industry narratives), and modernized POS/mPOS architectures.

* AI investment is accelerating rapidly, with retailers now allocating substantial portions of IT budgets to artificial intelligence initiatives that deliver measurable improvements in demand forecasting accuracy, markdown optimization, and operational efficiency.

* Technology leaders show dramatically higher optimization rates across all customer journey types, including BOPIS, ship-from-store, and local delivery – translating technology investments into superior customer retention and increased transaction values.

* The Windows 10 end-of-life deadline has exposed significant compliance and security gaps, with major percentages of retailers facing urgent migration requirements that create both risk and competitive repositioning opportunities.

"The laggards aren't just a little behind – they're being left in the dust at the store level," Buzek emphasized. "Over the past five years, leaders have grown their Store IT spending by 52% while laggards managed only 9%. That's a 5.8x difference. These laggards are still using the antiquated approach of tying next year's IT budget to last year's revenue, which guarantees they'll never catch up. Meanwhile, leaders are piloting technologies, validating ROI in 90-120 days, and scaling rapidly. The retailers who execute this discipline are the ones building sustainable competitive moats."

How Retail Leaders Outperform provides retailers and technology vendors with comprehensive benchmarking data across technology adoption timelines, investment priorities, financial performance metrics, and workforce impacts. The research quantifies which technologies deliver the strongest ROI, identifies optimal deployment sequences, and reveals the specific operational practices that separate high performers from the rest of the market.

Each company purchasing the study receives 125 custom data points specifically formatted for social media posts, infographics, and marketing communications, enabling technology vendors to demonstrate market momentum and retailers to benchmark their performance against peers. The study includes detailed segmentation by retail tier, vertical, and geographic region.

The research was conducted via web-based survey in Fall of 2025, capturing responses from over 400 brands retailers across Food/Drug/Convenience/Mass, General Merchandise Stores, and Hospitality segments. Forty-six percent of respondents represent retailers with over $1 billion in annual revenue, with 29% exceeding $5 billion. The study employed revenue-weighted analysis to provide market-representative insights across hundreds of data points.

The complete study is available for purchase at https://www.ihlservices.com/product/how-retail-leaders-outperform/ . Enterprise licenses include access to raw survey data, custom analysis capabilities, and the full suite of 125 pre-formatted data points for marketing use.

About IHL Group

IHL Group is a global research and advisory firm specializing in technologies for the retail and hospitality industries. For over 25 years, IHL has provided market sizing, technology benchmarking, and strategic advisory services to the world's leading retailers and technology vendors. With the most comprehensive research on retail technology adoption patterns, IHL helps clients understand market opportunities, competitive positioning, and technology investment priorities. For more information, visit https://www.ihlservices.com.

Gregory Buzek

IHL Group

+1 615-591-2955

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.